Flexible Spending Accounts (FSA) and/or Health Savings Accounts (HSA) are ideal medical plan options that can be used for LASIK surgery. One of the most popular benefits of using an FSA or HSA is the tax advantages that come with them as the accounts are funded with pre-taxed money. Whether you decide to choose an FSA or HSA plan, there are many benefits of utilizing either for your LASIK surgery.

What is an FSA?

An FSA, short for Flexible Spending Account, is exclusively an employer established benefit plan that can be used for medical expenses, dental care, and vision care. If your employer offers FSAs, you choose the dollar amount to be deducted from your salary to be deposited into your FSA account pre-taxation; essentially allowing you to use untaxed income to pay for medical services.

Your FSA is like health insurance, but it comes out of your own pocket (untaxed) and some employer contributions may be made on top of the specified FSA dollar amount cap ($2,850).

Candidates

If offered by your employer, any eligible employee can enroll in the Flexible Spending Account, and be qualified to make use of it towards many qualified medical expenses.

Benefits of an FSA

There are many benefits of an FSA plan to consider, including:

- Reduces income taxes

- Contributions avoid Federal, State, & Social Security taxes

- Increases spendable income

- Many medical expenses are eligible for reimbursement

What is an HSA?

An HSA, short for Health Savings Account, is very similar to an FSA account. It can be used for medical and healthcare costs to help pay insurance deductibles and qualified medical expenses, including those that may not be coved by health insurance, such as vision care. Like an FSA, you can control the dollar amount that goes into your HSA account. But unlike an FSA, an HSA balance rolls over from year to year, ensuring your health savings are not lost.

Candidates

Many employees with an employer-sponsored plan may be eligible to create an HSA as well as any individual who is self-employed may elect to set up an HSA. In addition, an employee must also be enrolled in a High Deductible Health Plan (HDHP) in order to establish an HSA.

An HDHP is an insurance plan with a low monthly premium but carries with it a higher than average minimum deductible.

Benefits of an HSA

Similarly to an FSA, an HSA plan has many benefits to consider, including:

- Reduces income taxes

- Tax-deductible contributions may earn interest

- Can be invested in mutual funds and stocks

- Others can contribute to your HSA

- Increases spendable income

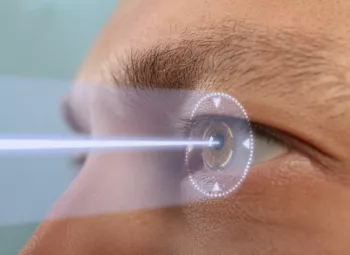

Using FSA or HSA for LASIK Eye Surgery

Having an FSA or HSA account can be useful, as it can help you cover some, if not all, of the cost of your LASIK surgery. Most LASIK surgery is not covered under medical or vision insurance, so an FSA/ HSA can be a financial lifesaver. Additionally, if your place of employment provides you a ‘grace period,’ (typically 2.5 months) you can combine remaining FSA funds from the previous year with FSA funds you currently have to be used within the grace period. Likewise, with an HSA you can use money rolled over from the previous year for your LASIK treatment as funds within an HSA roll over entirely from year to year.

If you are a candidate for a LASIK procedure please note when using an FSA or HSA, you should always be aware of the limits or rules for your accounts as not all medical or health expenses can be covered. The entire cost of a LASIK procedure may not be covered by an FSA account depending on which particular method of LASIK being performed.

With careful planning, an FSA or HSA account could potentially pay for a significant amount of a LASIK procedure pre-tax.

Financing with FSA or HSA for LASIK Surgery at NeoVision

If you would like to find out more about how you can use an FSA or HSA plan for LASIK surgery, please call our office or contact us online today! Our expert ophthalmologists will be happy to answer any questions you may have. Together, we can discuss your financing concerns and start you down the path to clear vision.

Originally published December 13, 2018. FSA contribution limits updated October 26, 2022.