Your Guide to Using Your FSA for LASIK Eye Surgery in 2022

If you have a Flexible Spending Account (FSA) through your work and find yourself with money left before the end of the year, LASIK can be great holiday gift to yourself. You can improve your vision and use your deferred funds before they’re forfeited. It’s a win-win.

In this article, you will learn about FSAs, the process of using one, and the benefits of using your remaining FSA funds to correct your vision with LASIK laser eye surgery before the end of the year.

What is an FSA?

An FSA (Flexible Spending Account) is an employer-provided healthcare benefit that allows employees to set aside funds, pre-tax, to pay for medical, dental, and vision care expenses within a given year. This does not replace the need for health insurance but helps bridge the gap for the medical expenses that the insurance does not cover.

FSA vs. HSAs

Health Savings Accounts (HSAs) are similar to FSAs but do have some important differences. For complete details, see your employer, or your bank, if you’re self-employed.

Here is a snapshot of how HSAs differ from FSAs

- Anyone can contribute to your HSA, not just you and your employer.

- You can have an HSA if you’re self-employed.

- You must also be enrolled in a high-deductible Health Plan to have an HSA.

- Unused HSA funds may be rolled over every year.

How Does an FSA Work?

When the benefit is present, employees set the dollar amount they wish to be deducted from each paycheck for deposit into the FSA account. Taxes withheld from each paycheck do not apply to the FSA deduction, rendering the deferred FSA funds tax-free.

How Much Can I Contribute to My FSA Every Year?

As of 2022, the yearly limit for employee-supplied FSA contributions is $2,850. Employers may make additional contributions to the FSA that exceeds the employee’s limit. When distributed back to the employer for qualifying expenses, the money remains tax-free.

How Do I Use My FSA Funds?

Typically, for each medical, dental, or vision expense, the employee submits receipts to their employer’s human resources department for reimbursement from the employee’s FSA account. In some instances, the employee may be provided with an FSA debit or pre-paid card, which can be used at the time of service, to pay the provider directly from their FSA account. Your employer will have information on how your specific FSA plan works.

Do My FSA Funds Expire?

Employees forfeit all unused FSA funds at the end of the year. Employers may, but are not required to, provide a grace period (up to 2.5 months) or allow up to $570 to be rolled over.

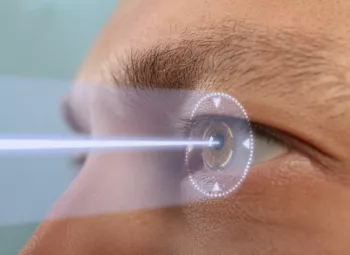

LASIK is an FSA Eligible Expense for 2022

Eye surgery to correct vision is an approved medical expense, according to the Internal Revenue Service. As such, FSA funds can be used to pay for LASIK.

Additional Benefits of Getting LASIK Before the End of 2022

In addition to using up your expiring FSA funds, there are a number of other benefits to getting LASIK before the end of the year.

Less to Pack on Holiday trips

After LASIK eye surgery, you can travel lighter, because you won’t have to pack glasses and contact solution.

Fewer Dry Eye Issues

Dry eyes are generally more pronounced in the winter months due to the dry air from indoor heaters. Contact wearers are especially hard hit. The additional irritation will leave when the contacts are gone.

Sun Goggles, not Glasses, on the Slopes

If you enjoy snow sports and wear glasses, after LASIK you can hit the slopes with non-prescription sun goggles instead of prescription sunglasses, and your eyes will be even better protected from the UV rays reflecting off the snow.

Save Money on Glasses and Contacts

With LASIK, you can spend money on holiday gifts instead of the myriad pairs of glasses, or the contacts and contact solution you formerly needed.

To learn more about these reasons to get LASIK this season, read “4 Reasons Why Now is the Best Time to Get LASIK.”

Use Your 2022 FSA Funds for LASIK Before it’s Too Late

If you have money sitting in your FSA that needs to be used before the end of the year, LASIK is like found money. It turns a scramble into an opportunity.

At NeoVision Eye Center, our LASIK specialists can permanently correct your refractive errors and drastically improve your vision quality with wavefront LASIK eye surgery. In a screening exam, a board-certified ophthalmologist can go over your health history and vision correction needs, and recommend the best treatment option for you.

We invite you to take the first step towards better vision by contacting us today for a free LASIK eye surgery consultation.

Sources: “People with coverage through a job: Using a Flexible Spending Account (FSA),” HealthCare.gov

“Publication 502 (2021), Medical and Dental Expenses,” IRS website

Schedule Your LASIK Consultation Today!

We invite you to take the first step towards better vision by contacting us today for a free LASIK eye surgery consultation.

"*" indicates required fields